The blanket coverage of coronavirus and its impact on the economy can lead to a lot of confusion right now. Some reports are hopeful of anti-viral drugs, others say a vaccine is at least a year away. There is talk of curve flattening but still rising cases and deaths. There is news of an easing in lockdowns but also worries about “second waves”. All this against a backdrop of collapsing economic data and surging unemployment. Some prognosticators say now is a great buying opportunity for investors whereas others see more financial pain ahead. This is a horrible time for humanity and particularly those directly affected by coronavirus, but I must say if ever there was a time to turn down the noise and listen to The Carpenters or Taylor Swift, this is it. Here is a summary of where we are currently at. First the bad news and then the good. I will keep it simple.

The bad news

-

The reported number of coronavirus cases globally is still rising and has now gone through 2.5 million.

-

The reported death rate is still rising and is now up to 6.9%.

-

Many worry about a “second wave” of cases. This occurred in the 1918 Spanish flu outbreak, and Singapore and Japan which had been cited as models for containment are now cited as examples of this (although they really still seem to be in part of a first wave as their quarantining efforts failed).

-

Most medical experts still say a vaccine may be a year or more away. I remember around 1984-85 constantly hearing a vaccine for HIV was a year away – but we are still waiting.

-

In the absence of a vaccine some worry about coronavirus outbreaks every winter as it migrates around the world.

-

Economic activity data is literally falling off a cliff. This was highlighted last week by the IMF’s forecast for a contraction in the global economy of 3% this year and in advanced economies of around 6%. And this masks a likely 10 to 15% slump in GDP centred on the June quarter. Falls of that magnitude have not been seen since the Great Depression. The collapse in economic activity in the US and Australia is highlighted by weekly economic activity trackers we have constructed based on data for things like restaurant bookings, energy usage, confidence, foot traffic and jobs.

Source: Bloomberg, AMP Capital

-

We are constantly hearing forecasts of unemployment going to 10%, 15% and maybe even 30% in the US (which does not have the benefit of Australian JobKeeper wage subsidies – if you are having a salary paid by JobKeeper then you will not be unemployed).

-

This in turn is creating much consternation around whether there will be an economy left once the shutdowns end and/or how governments will get their debt down.

-

Finally, the blame game is on. While partly politically motivated, US China tensions seem on the rise again.

The good news

-

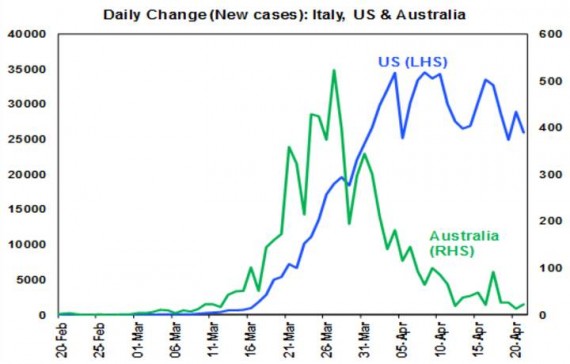

While the total number of coronavirus cases is rising, new cases appear to be levelling off or in decline.

Source: Worldometer, AMP Capital

-

Numerous European countries, led by Italy, look to be following the same path as China which saw a blowout in new cases, a lockdown followed 2-3 weeks later by a peak in new cases and then falling new cases. Australia appears to have been very successful in following this path (with the peak coming faster) and the US now seems to be following the same path, albeit its yet to show a decent downtrend in new cases. Social distancing clearly works! (Just out of interest – with various countries following the same pattern China has reported it makes me think the Chinese data on new cases is roughly right despite emerging scepticism.)

Source: Worldometer, AMP Capital

Source: Worldometer, AMP Capital

-

Following this, the focus is shifting towards an easing of lockdowns. Various European countries and New Zealand have already announced some easing, allowing some shops to open/activities to occur. The US has released guidelines for states to move through a three phased reopening if they meet various criteria (in terms of falling new cases & hospitals coping) before moving to each new phase.

-

While Australia’s PM Scott Morrison has indicated that current restrictions will remain broadly in place for another few weeks, he has indicated three criteria for an easing in restrictions: better testing; better contact tracing; and confidence in containing outbreaks all of which makes sense given the risks Australia faces coming into winter. Of course, successful anti-virals and/or a vaccine would make it all a lot easier, but we can’t rely on either just yet.

-

Most countries talking of easing are well aware of the risk of a second wave (although President Trump’s bravado about “liberating” states is worrying). Hence a focus on phased easing only once certain criteria – around testing, new cases and quarantining – have been met. This is very different to what happened in relation to Spanish influenza where there really wasn’t any testing. For Australia this is likely to mean a gradual opening up from May. In the absence of a vaccine, full international travel is likely to be the last thing to return. That’s not great but given that in net terms its worth less than 0.5% of GDP to the Australian economy, it’s trivial compared to the 10-15% hit that’s come from shutting or partially shutting about 25% of the economy as it would be this mainly domestically driven activity that would bounce back as the shutdown is eased.

-

Fiscal and monetary stimulus has been ramped up to the point that they should help minimise second round effects on economies enabling them to bounce back faster. This is particularly the case in Australia where the focus has been on job subsidies to preserve jobs, support businesses and low-cost RBA funding has enabled banks to offer loan payment holidays. Yes, there may be longer term issues in paying down debt, but they are small compared to the cost of allowing a bigger and deeper hit to the economy from not protecting businesses and incomes through the shutdown.

If, as appears likely, an easing of the lockdowns becomes common place in May/June, then April or maybe May should be the low point in economic data much as February was in China. This does not mean that things will quickly bounce back to normal – some businesses will not reopen, uncertainty will linger, debt levels will be higher and business models will have to adapt to different ways of doing things around working and shopping. On our forecasts it will look like a deep V recovery in terms of growth rates, but looked at in terms of the level of economic activity it will take a lot longer to get back to normal and this will mean that it will take a while to get unemployment down – from a likely peak in Australia of around 10%. But at least growth will be able to return and spare capacity and high unemployment will mean that it will take a while for inflation to pick up and so low rates will be with us for a long time.

This is all very different to five or six weeks ago when there was talk of six-month lockdowns, no confidence as to whether they would work and the policy response was seen as inadequate.

What does it mean for investors?

From their high in February to their low around 23 March, global shares fell 34% and Australian shares lost 37% as all the news was bleak. Since that low to their recent high, shares have had a 20% plus rally helped by policy stimulus and signs of coronavirus curve flattening. But this strong rally has left them a bit vulnerable in the short term – particularly as we have now entered a period which is likely to be see very weak economic data and news on profits. The ongoing dislocation in oil prices – to a “record low” of -$40 a barrel for West Texas Intermediate – has added to this, although lower petrol prices are ultimately more of a help than a hindrance to a recovery in economic activity. So, the very short-term outlook for shares is uncertain and a re-test of the March low cannot be ruled out.

However, shares are likely to be higher on a 1-2 year horizon as evidence of curve flattening, easing shutdowns combined with policy stimulus ultimately see a return to growth against a background of still very low interest rates and bond yields.

From a fundamental investment point of view the historical experience that covers recessions, wars and even pandemics (in 1918) tells us that the long-term trend in shares and other growth assets is up and that trying to time bottoms is always very hard. No one will ring the bell at the bottom, which by definition will come at a time of maximum bearishness when all the news is horrible. Maybe the low was back in March, maybe it wasn’t. To borrow from John Kenneth Galbraith’s famous quote on forecasters I will admit that I know that I don’t know1. So a good approach for long-term investors is to average into markets after bear market falls over several months.

1 “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – JK Galbraith.

Source: AMP Capital 22 April 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.