From the get-go back in March, as coronavirus lockdowns hit, there has been much debate about what this recession would be like: how deep and long would it be? Was it going to be a recession like those in decades past or more like the Great Depression of the 1930s? Would it look like a V, a U, a W or an L? Or even a K, square root or a swoosh? These questions gained added currency when actual data showed a bigger hit to economies than what was seen at the end of WW2 or the Great Depression and then confusion reigned as much data showed very steep rebounds. But one thing that seemed clear at the start was that it would be very different to past downturns and this is now even more apparent.

Five reasons why this time is a bit different

There are basically five reasons why this downturn and subsequent recovery is different to those of the past:

-

First, it was caused by government mandated shutdowns and changed individual behaviour to control the spread of coronavirus. This contrasts to normal economic downturns that are preceded by a period of excess (in investment, consumer spending, private debt and inflation) that have to be unwound often with the help of monetary tightening.

-

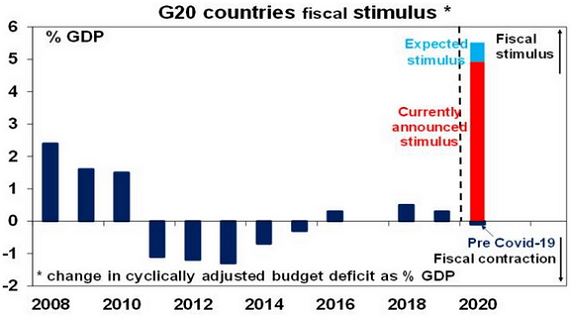

Second, we have seen massive upfront monetary and fiscal easing which has propped up businesses, jobs, incomes and the flow of credit relative to what otherwise would have occurred. Interest rates have gone to record lows, quantitative easing has become the norm and most importantly fiscal stimulus as a share of GDP in developed countries has been at a record levels. This is in stark contrast to most post war recessions that have seen policy response come with a lag as it’s taken longer to realise the economy needs help. And in the Great Depression, monetary and fiscal policy was first tightened.

Source: IMF, AMP Capital

-

Third, debt payment holidays, rent moratoriums and a relaxation of insolvency rules have been put in place to avoid the sort of business failures, distressed asset sales, layoffs and hardship that normally occurs in recessions. This has seen for example, company insolvencies in Australia run at around half the level of prior years since April. And the lack of forced sales and income protection partly explain why home prices have held up relatively well.

-

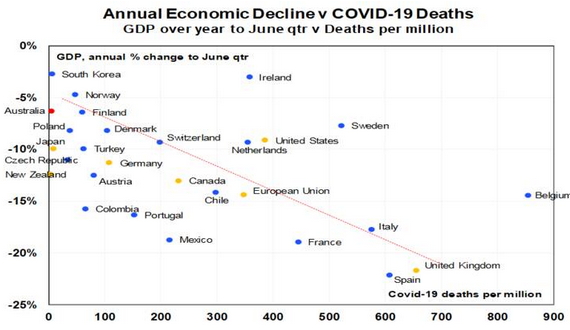

Fourth, it’s dependent on containing the virus. This was seen in terms of the severity of the economic downturn in the first half being less in countries with less deaths from the virus, like Australia. Likewise getting it under control will play a big role in determining the recovery. There are good prospects for vaccines but assuming a reasonable degree of efficacy, it may take 6-12 months before enough people have had it to develop herd immunity. In the meantime, much will depend on social controls, tracing & quarantining.

Source: ourworldindata.org, Bloomberg, AMP Capital

-

Finally, the coronavirus shock is likely to have accelerated structural change by more than is normal by driving an even faster embrace of technology in terms of online retailing, working from home, digital meetings, etc. This is not all negative and could mean faster productivity (less time commuting, less time in meetings, less time travelling) but it could result in higher than otherwise structural unemployment (e.g. less jobs associated with commuting and offices, less jobs associated with business travel and less jobs in retailing).

The outworking of all this is likely to be:

-

A sharp initial rebound in economic activity as businesses reopen and people return to work.

-

Followed by the remainder of the recovery being slower and bumpy reflecting periodic outbreaks of the virus and renewed restrictions, some sectors taking longer to recover (eg, travel jobs) & as structural change impacts some jobs.

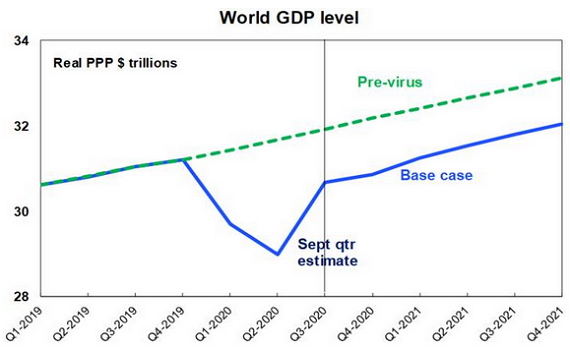

The Australian recession and recovery

This pattern looks to have been what we have seen so far globally with very sharp falls in GDP in the first half followed by a strong rebound in the September quarter (with GDP data for the US and Europe to be released later this week likely to show an 8% or so rebound), followed by a more uncertain and gradual recovery going forward – particularly as the resurgence of the virus leads to tightening restrictions in Europe (as we are now seeing in France and Germany) and possibly the US. This can be seen in our projections for the level of real global GDP in the next chart. In particular, global GDP will take years to get back to its pre-coronavirus level which means a long period of spare capacity and low inflation/low interest rates.

Source: AMP Capital

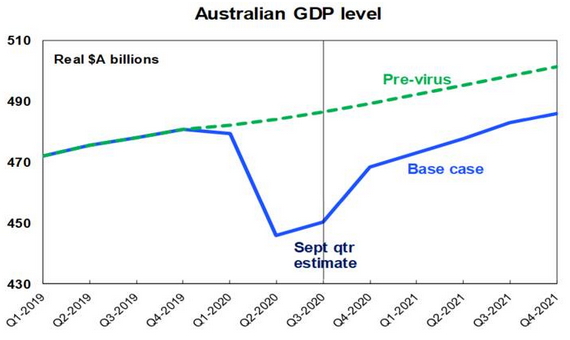

The Australian economy looks to be following a similar pattern, although the initial recovery has been slowed through the September quarter by Victoria’s hard lockdown. As a result, we only expect 1% or so growth in the September quarter, but a stronger rebound in the December quarter as Victoria reopens. Our forecasts for the level of real Australian GDP are shown in the next chart. Note that while a return to growth in the September quarter will mean that technically the recession is over – this really is just a technicality because the level of activity will still be a long way below its pre-coronavirus level.

Source: AMP Capital

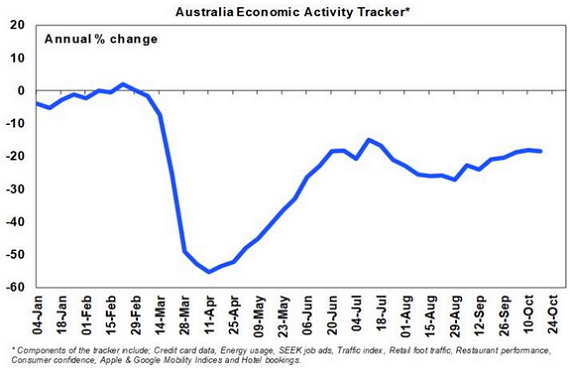

Because most traditional economic data is infrequent, we have constructed Economic Activity Trackers for the US and Australia which track weekly data releases for things like traffic, direction requests from phones, confidence and spending. This clearly shows the initial hard decline in the economy into mid-April, followed by a strong bounce into July on reopening. The recovery then faltered a bit and now seems to be getting back on track with Victoria reopening.

Source: AMP Capital

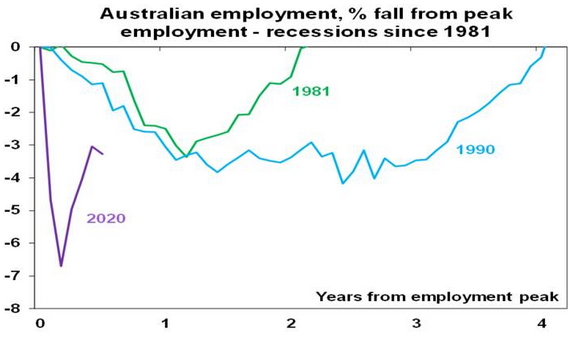

A sharp hit followed by an initial “deep V” rebound can also be seen in Australian employment, which has now recovered about half the job losses seen in April and May.

Source: ABS, AMP Capital

Both our Australian Economic Activity Tracker and employment have seen a sharp rebound but remain a long way below pre-coronavirus levels. In terms of the jobs market, this is reflected in “effective unemployment” (ie, adjusting for JobKeeper and reduced participation) of 9.6% and underemployment of 11.4%. So, while Australia has seen some “recovery,” we have a long way go yet to say that we have “recovered”. Our assessment is that the recovery will continue but beyond a December quarter bounce fuelled by reopening, this will be more gradual and bumpy for the reasons noted earlier as some jobs take longer to recover and some won’t come back at all due to structural change and so will need to be replaced by new jobs which will take time, as government supports wind down and as the hit to immigration impacts the property market.

Concluding comment

As we noted back in May in The Lucky Country, Australia has performed far better than many comparable countries in controlling coronavirus, it has seen a stronger economic policy response and its major trading partner in China is well into economic recovery. This along with a bit of luck should result in a stronger, more assured recovery in the Australian economy compared to many other comparable countries which should ultimately benefit Australian assets relative to global assets.

Source: AMP Capital 29 October 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.