Introduction

The Government’s decision to revamp the Stage 3 tax cuts has stirred up a hornet’s nest. The move to reduce the size of the benefits for higher income earners (with those on $200,000 or more getting $4546 a year less) and redistribute them to lower and middle-income earners (with those earning between $50,000 and $130,000 now getting $804 a year more) in order to provide cost of living relief is something that’s easy to understand.

The arguments against it though are a bit more esoteric.

-

First, is the politics around committing in the last election and until recently to proceed with the tax cuts as legislated (despite cost of living issues long being well known) only to then break the commitment.

-

Second, is the concern that the move treats the symptoms and not the causes of high inflation and risks backfiring. This is because by skewing them to low- and middle-income earners who consume a higher proportion of their income runs the risk that it will add to demand and hence inflation. This risks delaying interest rate cuts.

-

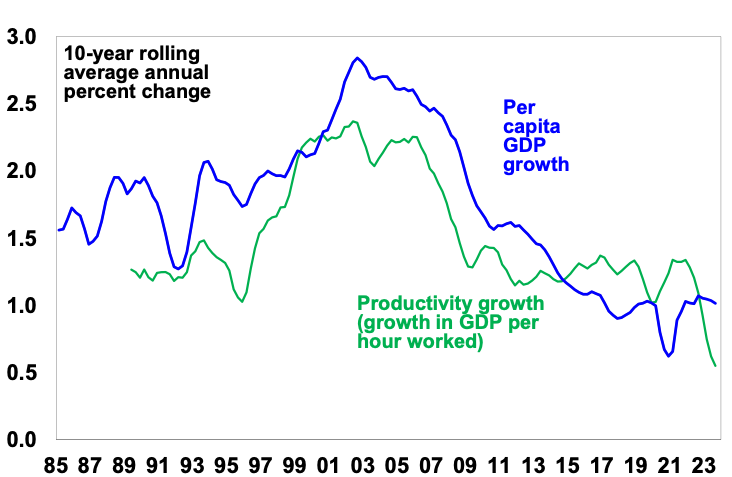

Finally, is the argument that it’s yet another backward step in terms of tax reform. This is critical as in recent years Australia’s productivity performance has deteriorated. This has driven a slump in growth in per capita GDP which means lower than otherwise living standards.

Australian Labour Productivity Growth

Source: ABS, AMP

To boost productivity growth we need to do a bunch of things (there is a short list here) but a key thing is to reform our tax system. The Stage 3 tax cuts were a step in that direction because they reduced the issue of bracket creep (where taxpayers jump into higher tax brackets never intended for them just by seeing average wages growth). It did this by having one flat 30% tax rate for earnings between $45,000 & $200,000. They were also part of a three-stage process with the first two focussed on low and middle income earners. The Stage 3 tax changes unravel this modest reform.

Why the need for tax reform?

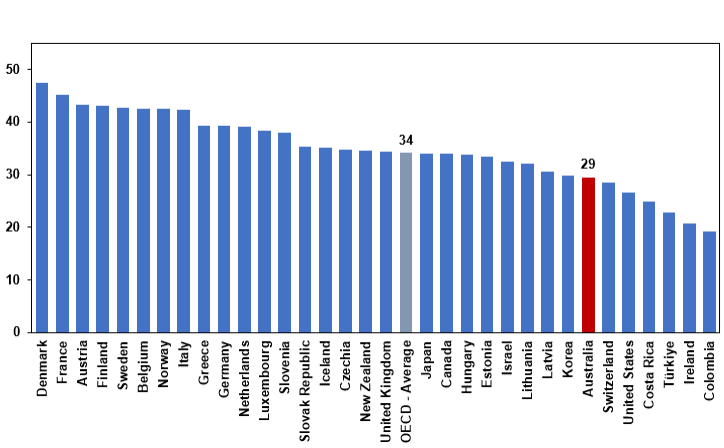

The good news is Australia is a relatively low tax country. Total tax revenue as a share of GDP at 29% in 2022 was at the low end of OECD countries.

Total Tax Revenues, % of GDP

Source: OECD, AMP

The complication is that this does not tell the whole picture because it doesn’t include superannuation contributions. If adjustment is made for this then we are likely more in the middle of the pack. More fundamentally there are five key issues with our tax system:

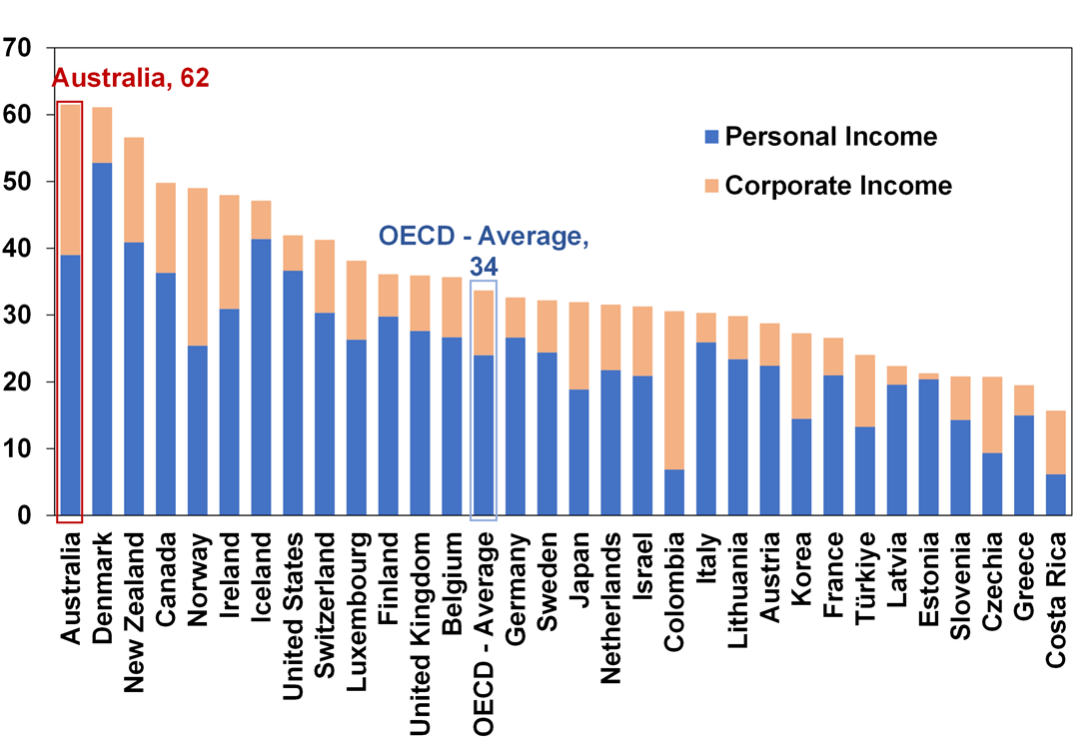

#1 – It’s very reliant on income tax, either personal or corporate, as opposed to indirect tax like the GST

Income tax is 62% of tax collections versus the OECD average of 34%.

Income as % of total tax revenues

Source: OECD, AMP

The problem with this is that income tax is highly distortionary – as it impacts decisions to work and invest – whereas a GST levied at the same rate on all items is far less distortionary. So a GST is a far more efficient tax than income tax and a greater reliance on it versus income tax will likely lead to more productivity. The high reliance on income tax will also create equity issues as the aging population will see an increasing burden placed on younger workers to foot rising health and aged care bills. Of course, the GST is also more regressive hitting lower income earners harder, but this can be addressed by the setting of the tax scales and compensation.

#2 – It’s complicated with various “tax concessions”

Several “tax concessions” are often in the headlines: negative gearing, the capital gains tax discount, franking credits, superannuation and trust structures. The arguments put up for curtailing them are that they cost the government revenue, create distortions in the tax system and that the benefits fall mainly to high earners. It’s actually more complicated than this:

-

Negative gearing arises due to the way the tax system works in allowing deductions for expenses incurred in earning income. Removing or curtailing it for property investment as some want will create a distortion as it will still be available for investment in other assets. What’s more negative gearing is not the reason housing affordability is poor and removing or curtailing it could make the situation worse by reducing the supply of rental property. Finally, while the dollar value of negative gearing rises with income the majority of taxpayers that negatively gear property are middle-income earners. That said there may be a case for curtailing excessive use of this tax concession.

-

The capital gains tax discount allows investors to halve their taxable capital gain on an asset if they hold it for more than a year. The discount does appear excessive though and it provides an inducement to earn income as a capital gain as it’s taxed at half the rate. So there is a case to consider removing the capital gains tax discount and return to the pre-1999 approach of adjusting capital gains for price inflation.

-

Dividend imputation is a sensible concession that removes a bias against equities by removing the double taxation of earnings – once in the hands of companies and in the hands of investors as dividends. Therefore, it puts shares onto a level footing with corporate debt. So, it reduces the incentive of firms to excessively rely on debt and encourages firms to pay decent dividends as opposed to hoarding earnings. Curtailing dividend imputation would be a big mistake.

-

The case for super tax concessions to remain is strong in terms of boosting savings, supporting a large pool of patient capital, providing for self-funding in retirement and reducing reliance on the pension.

Finally, calls to end or curtail the various tax concessions need to be assessed in the context of the whole tax system in Australia.

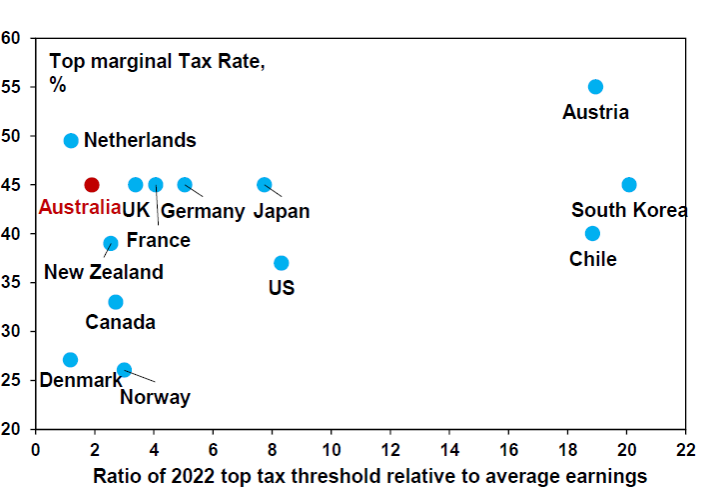

#3 – The Australian tax system is highly progressive

In this regard, not only does the Australian tax system have a high reliance on income tax but it is highly progressive. The current top marginal tax rate at 47% (including Medicare) is above the median of comparable countries and kicks in at a relatively low multiple of average weekly earnings.

Global individual tax rates comparison

Source: OECD, AMP

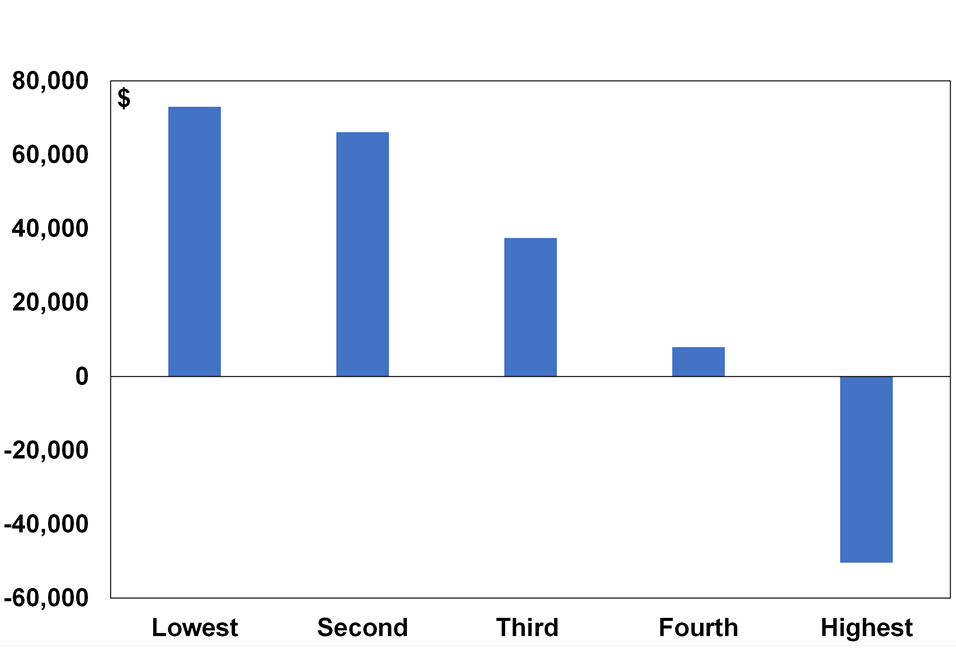

As a result, the Australian individual tax system is highly progressive and this is reflected in the fact that the top 3.6% of tax payers earning more than $180,000 pay around 32% of income tax and the top 10% pay nearly 50% of income tax. ABS data also indicates that only the top 20% of income earners pay more tax than they receive in government transfers. This is likely working against Australia’s long-term interest to the extent that it discourages work effort and hence productivity.

Government benefits less taxes paid by household income groups, 2021-22

Source: ABS, AMP

Curtailing access to any or all of the “tax concessions” will only add to the burden on this relatively small group and act as a disincentive for work effort at a time when we should be doing the opposite. Ideally, we should be looking to reduce the reliance on income tax. If we did this the interest in strategies like negative gearing would likely decline.

#4 – Bracket creep is an ongoing issue

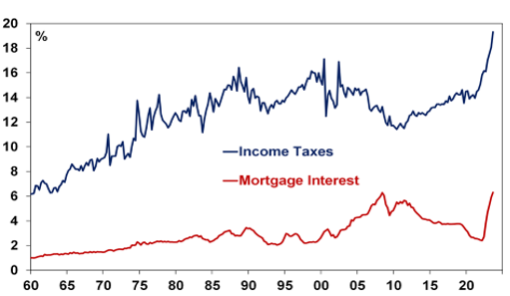

Just keeping up with inflation can see a worker pushed into a tax bracket that was never intended for them. Bracket creep has been a major contributor to the rise in income tax payments as a share of household income to a record level. Over the last two years increasing tax payments have been more of a drag on income than higher mortgage payments.

Household Payments, % of Gross Income

Source: ABS, AMP

The ideal solution is to index the tax brackets to inflation. This would keep the Government accountable by denying them the ability to give back bracket creep and claim it’s a tax cut and force them to pass higher tax rates through Parliament if they want more tax revenue.

#5 – The tax system has numerous anachronisms

Key issues are that: the GST applies to a diminishing share of consumer spending; states’ stamp duties grossly distort property decisions and worsen housing affordability and should be replaced with land tax; state payroll taxes discourage employment; car tariffs are still levied when there is no car industry to protect; and road user charges need to replace fuel excise to avoid a diminishing share of road users paying for roads.

So what to do?

What is needed by way of tax reform is simple: lower personal tax rates with higher thresholds; a lower corporate tax rate; a higher and more comprehensive GST; compensation of low income earners and welfare recipients for increasing the GST; the indexation of tax brackets to inflation; and the removal of stamp duty & its replacement with land tax.

This would take political courage as seen a generation ago. But failure to do so will only hamper productivity and living standards for all Australians.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital February 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.