While “rona” was selected by Macquarie Dictionary as 2020’s word of the year, “stir-crazy” would have made it onto many peoples’ shortlists. From closed borders to seating quotas, we have had to contend with various forms of restrictions since the onset of the COVID-19 pandemic. Thankfully, cases in Australia have remained under control and life has started to return to normal with mobility indicators and economic activity on the rise.

While some apprehension and cautiousness remains, induced by semi-frequent cases and city-level restrictions, the vaccine rollout is beginning to pick up pace and we are confident these hiccups will occur less often, and the economy will feel the benefit of unbridled consumers in 2021.

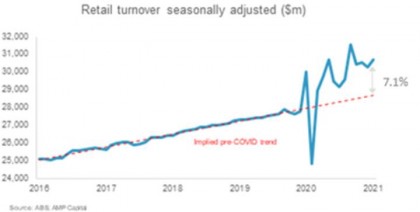

Retail sales higher than the pre-COVID trend

Consumers, and by extension retail, have been key beneficiaries through the pandemic.

Between superannuation accounts becoming temporary ATMs to the tune of $37.3 billion, government payments (e.g. JobKeeper), and a recovering labour market, household disposable income is now 4.8% higher than a year ago1. Add a decent chunk of the money ordinarily spent on travel and the positive wealth effect of rising house prices and it’s no surprise retail sales are sitting 7.1% higher than the pre-COVID trend. The good news is there’s more fuel left in the tank.

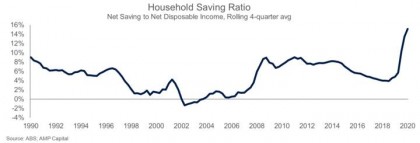

Disposable income savings ratio at its highest since June 1981

The ABS household disposable income savings ratio has averaged 15.2% over the past four quarters, its highest level since June 1981 and well above the 5.7% pre-COVID (March 2020). Household bank deposits now total $1.12 trillion, representing growth of $124 billion in the 12 months to March 2021, with almost $31 billion deposited in the month of July alone2. These new deposits can be viewed as $124 billion of dry powder ready to be spent by consumers, as their confidence improves and job security becomes a lower priority.

While there is no guarantee that households will behave in this way – spend down savings – there are two factors which support this case: positive consumer confidence and current government policy.

Consumers engaged, employed and confident

Firstly, consumers are engaged and confident. Recessions typically cause ‘economic scarring’ – lingering negative effects which can impact employment, education, health and other outcomes for many years (if not generations). One of the ways this can manifest is discouraged workers, who exit the labour market because they are disenchanted with the prospect of finding suitable employment. This was seen in the aftermath of the early 1990s recession in Australia, where the labour participation rate didn’t reach its July 1990 level until March 20053.

Despite the severe shock to employment which occurred through 2020, participation now sits at a near-record 66%4, as employees’ connection with business was successfully maintained through wage support programs. This is being reflected in measures of consumer confidence.

Westpac’s survey puts sentiment at its second-most optimistic level since August 20105, despite the latest reading taking place after JobKeeper had ended. The sub-index tracking the outlook for family finances over the next 12 months is 7% higher than a year ago, while the unemployment expectations index is sitting at 100.2 versus the long-term average of 129.9 (lower equals better). These sentiment readings point to limited concerns about job security and prospects and are positives for consumers’ propensity to spend their extra savings buffer.

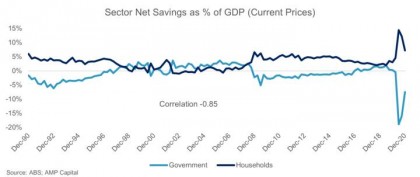

Current government policy

Secondly, the policy settings of the government and RBA are likely to nudge behaviour in this direction. Like gravity, the laws of accounting are immutable – every debit has a credit, each dollar spent is a dollar in the pocket somewhere else. The financial good fortune of households through the pandemic, that is, the run-up in savings, is due to the spending of government on the other side of the ledger. Consequently, the budget deficit is projected to reach $161 billion this financial year, while net debt as a percentage of GDP will peak at 40.9% in 2024-25 (24.7% in 2019-20)6.

To address the deficit and debt burden, we expect that government policies around the world are likely to adopt a growth-oriented approach known as financial repression. This aims to stimulate real economic growth while keeping interest rates (cost of debt) low, eroding government debt over time by growing GDP faster than interest repayments. This approach negatively impacts ‘savers’ and incentivises the spending or investment of excess funds.

A retail sector boost not enough to stop the need to evolve

While the drawdown of consumer savings will provide a boost to the retail sector, the benefit will be moderated by weak population growth and the accelerated adoption of e-commerce.

Historically, population growth has been stable and strong at ~1.5% per year7, with a direct flow-on to retail – more people needing to buy goods and services equals higher sales. Looking forward, population growth is expected to be 0.1% in 2020-21 and 0.2% in 2021-228, with net migration not expected to be turning positive until 2022-23 nor returning to normal levels until 2024-259.

One of the big winners through COVID-19 has been the e-commerce sector, which increased from 6.4% to 10.0% of total retail sales (February 2020 vs March 2021)10. Shopping centres will need to work harder to earn their share of consumer spending, by continuing to evolve into multi-use visitation destinations in step with the needs and wants of local communities.

As these shifts continue, we expect the performance divergence between ‘the best’ and ‘the rest’ to widen and for those centres and retailers who can keep up with the changing face of retail, the future looks bright.

1 ABS, as at 31 December 2020.

2 APRA, as at 31 March 2021.

3 ABS

4 ABS, as at 30 April 2021.

5 Westpac-Melbourne Institute Index of Consumer Sentiment, May 2021.

6 https://budget.gov.au/2021-22/content/overview.htm#two

7 ABS

8 https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/BudgetReview202021/Immigration

9 https://www.afr.com/politics/federal/migration-won-t-return-to-pre-covid-19-levels-for-years-20210510-p57qmg

10 ABS

Author: Luke Dixon, Head of Real Estate Research – Real Estate Sydney, Australia

Source: AMP Capital 10 June 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

AMP Capital Asia Limited (CE Number: AUN326) is regulated by the Hong Kong Securities and Futures Commission (“SFC”) to conduct Type 1 (Dealing in Securities), Type 4 (Advising on Securities) and Type 9 (Asset Management) regulated activities in Hong Kong. This material has not been reviewed by the SFC and is provided to you on the basis that you are a Professional Investor as defined in the Securities and Futures Ordinance (Cap. 571) (“SFO”) and subsidiary legislation. This material is provided for your use only and you will not distribute or make this material available to a person who is not a Professional Investor as defined in the SFO. This material is for general information purposes only and does not constitute advice or recommendation to buy or sell investments.

The information in this document contains statements that are the author’s beliefs and/or opinions. Any beliefs and/or opinions shared are as at the date shown and are subject to change without notice.