The impact of global economic trends on the demand for new infrastructure assets and the growth of existing ones cannot be underestimated.

On this front, the World Bank 2018 Global Economic Prospects – which provides economic forecasts out to 2020 and insights on the prospects of both developed and emerging economies – provides both good and bad news. The good news is that the global economy may at last be returning to sustainable global growth following the global financial crisis (GFC). As the World Bank notes:

“About half the world’s countries are experiencing an increase in growth. This synchronised recovery may lead to even faster growth in the near term, as stronger growth in, say, China or the United States spills over to other parts of the world. All the consensus forecasts for 2018 and 2019 reflect optimism. And this growth is occurring for the right reasons – investment and trade growth.” 1

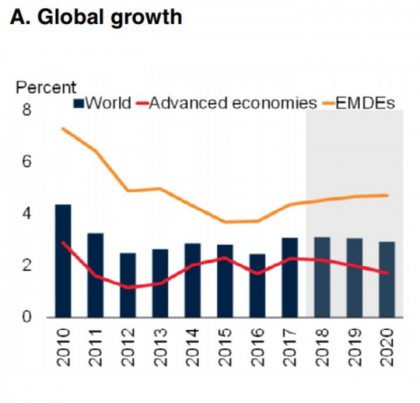

This optimism is reflected in their forecast of world growth over the next few years as shown in Figure A below.

Source: World Bank Group, Global Economic Prospects, TH eTurning of the Tide? 2018.

This forecast highlights the growing contribution of emerging markets and developing economies (EMDEs) on future global growth. Growth in developed (or advanced) economies is projected to moderate gradually as current stimulus initiatives are withdrawn and labour market slack decreases, before a moderate level of sustainable growth is reached.

However, the bad news is that the World Bank also highlights forecast growth is highly sensitive to two factors:

-

Continuing access to reasonably priced debt to allow ongoing investment. The wind down in stimulus packages in developed economies will reduce liquidity and cause rising interest rates globally which may affect investment in highly leveraged EMDE economies.

-

The rise of geopolitical risk, particularly popularism and protectionism in developed economies. This has the potential to hurt growth in both developed and EMDE economies.

The impact on infrastructure

Future economic growth is important for infrastructure investors. An understanding of likely economic trends allows us to estimate the potential demand for new infrastructure and effects on existing infrastructure asset performance and valuations.

Historically, the performance of a nation’s infrastructure has been a key determinant of that nation’s economic performance. For example, US studies on the benefit-cost ratio of highways in Texas show that it could exceed 6:1.2 More locally, recently benefit-cost analysis on Sydney’s West Connex F6 motorway indicates a benefit cost ratio of 2:1.3

Conversely, inadequate transport, communications and energy infrastructures are often limitations to growth in emerging and developing economies. High interest rates can also dampen investment and subsequently slow growth.

Infrastructure investment characteristics

Infrastructure offers a range of very diverse investments which can broadly be categorised as shown in the following table.

|

Infrastructure category |

Risk return profile |

Growth/Yield |

Comments |

|

Cash flows linked to GDP growth (eg: airports, ports, communications, logistics, toll roads) |

Higher risk/higher returns |

Predominantly capital growth |

Equity type returns (not a bond proxy) |

|

Economically regulated (eg: energy and water utilities) |

Medium risk/medium returns |

Predominantly yield |

Good bond proxy |

|

Public Private Partnerships (eg: hospitals, schools and courts) |

Lower risk/lower returns |

Highest yielding including return of capital |

Better bond proxy. Fixed term development and operational concession under contract to government. Most risks, including demand and inflation passed through to government. |

From this table, it is apparent that cash flows of different types of infrastructure assets may respond differently in a sustained, moderate growth, post-GFC environment.

-

In a gross domestic product (GDP)-linked asset, a return to sustained growth would result in sustained growth in future cash flows and give investors the confidence to invest for future growth. Bond rates could also be expected to rise in a sustained growth environment, increasing debt costs. However, as cash flows are also likely to increase, the net impact on valuations should be positive with moderate economic growth and prudent gearing levels.

-

For economically regulated assets, most economic risks are passed through to consumers over the longer term. That is, over the longer term, net cash flows should be largely indifferent to the changing economic circumstances, although the regulatory cycle may impose delays. Utility-style infrastructure has traditionally been a ‘go to’ investment in times of market uncertainty, as infrastructure cash flows may, in large part, be decoupled from market and economic cycles. This characteristic led to many investors using utilities as a bond proxy as a consequence of the post-GFC erosion of bond yields.

-

Public Private Partnerships (PPP) enjoy many of the protections of economically regulated assets, with minimal regulatory risk. They are, however, exposed to limited operational risk (e.g. an obligation to maintain facilities in a fit-for-purpose condition) and debt financing risk. Pass through of consumer price index (CPI) and debt hedges protect against interest rate increases. However, as PPP’s are effectively a bond proxy, improving bond yields may reduce demand for such assets.

Unlisted/Listed infrastructure investments

Infrastructure equity investments can be accessed either through unlisted or listed markets. While the operational results for listed and unlisted assets tend to be are similar, the difference in market access has important effects on the characteristics of the investments, as summarised in the table below. These differences can be exploited to increase diversity and reduce volatility in an infrastructure portfolio.

For most retail investors, an investment in a specialist fund is the most practical way to invest in both unlisted and listed assets as this brings down the minimum investment size to reasonable levels, while also enabling access to well diversified portfolios. For example, while there are some high-quality infrastructure companies listed on the Australian stock exchange, there is only a small handful of them. This means investing directly in these stocks makes it hard to implement a well-diversified infrastructure portfolio. Investing through a specialist fund typically provides exposure to a well-diversified global infrastructure portfolio.

The following table summarises the characteristics of both unlisted and listed infrastructure investments and is based on AMP Capital’s more than 20 years of experience of infrastructure investing.

|

Factor |

Unlisted |

Listed |

Comments |

|

Typical retail investor minimum investment size |

+$10,0004 |

+$10,0005 |

As noted above, for most retail investors, an investment in a specialist fund is the most practical way to access both unlisted and listed assets. |

|

Valuations |

Fundamental Discounted Cash Flow |

Market Caps |

Listed assets are exposed to public market sentiment. |

|

Total return range (% per annum)6 |

7%~12% |

8%~12% |

Over the longer term returns for similar types of assets tend to be similar. |

|

Yield range (% per annum)6 |

3%~9% |

3%~5% |

Listed PPP assets tend to trade at high multiples to net asset backing reducing yield in comparison to unlisted PPPs. |

|

Risk (% annum volatility)6 |

5%~10% |

10%~15% |

Listed market sentiment causes higher volatility. |

|

Liquidity |

Limited |

Daily |

Specialist hybrid funds (which include both listed and unlisted assets) can offer improved liquidity. |

|

Dept of market |

$US1 tr. |

$US2.5 tr. |

Listed markets have greater depth, primarily through access to US utility assets. |

Considerations for portfolio construction

The above considerations highlight the benefits of maintaining a well-diversified infrastructure portfolio. For example, if the World Bank forecasts prove to be substantially correct, we would expect to see some softening demand for bond proxy-type assets, while growth-linked assets would prosper.

If the risk factors highlighted by the World Bank dominate, producing a lower growth outcome, we expect demand for bond proxy assets would still remain high while valuation growth for growth assets would remain at current levels.

Additionally, a mix of listed and unlisted assets in a portfolio provides further diversification opportunities such as:

-

The different basis for unlisted and listed valuations means that the movement in valuations is largely uncorrelated (that is, they don’t necessarily move in the same direction at the same time). For example, listed markets usually respond negatively to an interest rate movement. As discussed above, interest increases may have very little impact on the fundamental valuation of unlisted assets, or may even be positive in the case of a growth-linked asset. This means that the movement in valuations in a combined listed/unlisted infrastructure portfolio can cancel each other out to a degree, effectively reducing overall portfolio risk.

-

Listed markets provide access to assets which are not generally available as unlisted investments, for example, US utilities. This allows greater geographic and sector diversification.

Final thoughts

The World Bank forecasts clearly show the increasing reliance global growth has on EMDE performance. Growth in EMDEs will drive the need for additional infrastructure in those economies, which in turn will lead to an expanded set of infrastructure investment opportunities for investors over the medium term. At the same time, while growth in developed economies is not expected to be as strong as in the EMDEs, there will still be a need for substantial infrastructure spend in those markets due to themes such as replacing existing ageing infrastructure, the advent of disruptive technologies, and the ageing demographic.

Author: Greg Maclean, Global Head of Research, Infrastructure

Source: AMP Capital 4 December 2018

1 World Bank Group, Global Economic Prospects, The Turning of the Tide? 2018.

2 McFarland, W and Memmott, J. Ranking Highway Construction Projects: Comparison of Benefit-Cost Analysis with Other Techniques.

3 Infrastructure Australia, Project Business Case Evaluation, West Connex, 2016.

4 AMP Capital Core Infrastructure Fund

5 AMP Capital Global Infrastructure Securities Fund (Hedged)

6 Based on observed long-term historical performance. Performance may vary according to a range of factors including economic conditions, the type of asset and market cycles. Past performance is not an indicator of future returns.

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.