There are several global events and themes on our radar for the remainder of 2019 and moving into 2020. Those who recognise the utility of bonds in a broader investment portfolio should take note of these broader conditions.

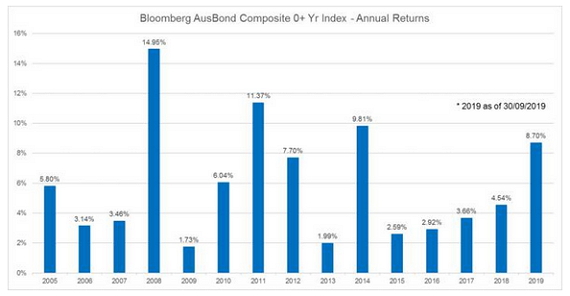

There have been strong gains for bonds in recent months, after a period of declines. An example from the Australian market is pictured below. Part of the reason for this could be that bond markets are responding to an anticipated global economic recovery.

Source: Bloomberg, as at 30/9/2019

Here, we take a look at some key events on the global stage that impact fixed income markets.

Financial conditions

Policy easing has contributed to more supportive financial conditions worldwide, which is one to watch moving into 2020.

In fact, the monetary easing put into effect this year is one of the reasons our chief economist, Shane Oliver, holds some optimism about the global economy for the year to come.

That said, central banks are expected to remain dovish for a period, and in some cases, constrained in their ability to offer further support. The Reserve Bank in Australia, for example, has called on the federal government to introduce fiscal stimulus into the economy.

Growth on the global stage

Economic growth internationally is, as ever, one to watch. Broadly speaking, although monetary policy is set to have an impact, conditions are still soft and the risk of recession lingers.

Further, there are ongoing weak spots of note. For example, there is an increasing risk that trade-induced weaknesses in both Europe and Asia are becoming entrenched. Given time, this may begin to spill over into the United States.

In addition, core inflation has been suppressed, but looks set to be moving slowly higher if growth can rebound globally.

Trade tensions

The fixed income market is also not immune to the knock-on impacts of an event which has had a far-reaching impact on international economies since it began: the US-China trade war.

The political climate in the US, as it heads towards the federal election in 2020, could prompt a short-term breakthrough. US President Donald Trump will be under pressure to keep the economy stable, and progress on trade talks with China would be favourable for his campaign.

Nevertheless, the conflict remains a key risk to watch and monitor for impact.

In focus: the Australian market

No doubt, in a lower-for-longer environment, investors in the Australian market would be questioning the utility of a bond portfolio.

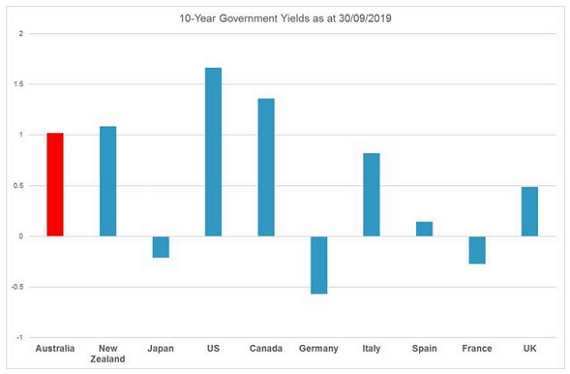

Source: AMP Capital Global Fixed Income team, 30/09/2019.

Granted, Australian bonds will not be able to provide the same defensive attributes that they have historically, given the multi decade falls in yield, but in a world of ever increasing negative yielding debt, Australian bonds continue to offer defensive characteristics. Australian bonds whilst offering a low yield, remain a triple AAA rated, liquid, defensive asset, that is attractive to many of its peers.

Author: Ilan Dekell, Head of Macro Sydney, Australia

Source: AMP Capital 5 Dec 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.