One of the most common images associated with retirement is finishing work and walking away with a lump sum of super money to splurge on a new car, boat, caravan, holiday, or perhaps if you’re lucky, all of the above.

But it’s an outdated stereotype. Research shows that in the 10 years from 2004 to 2014, the payment of super as an income stream increased far more quickly than lump sum payments did, and by 2014 only around 16 per cent of retiring Australians took their super in the form of a lump sum.1

But are Australians right in their preference for income streams rather than lump sums? And is there another alternative?

When lump sums pay off

There are some benefits to taking lump sums.

Depending on the retiree’s circumstances taking a partial lump sum may be the best option if you have outstanding debts or health issues that require expensive treatment.

The Australians that do take lump sums mostly use them sensibly: they use the funds to pay off mortgages and debts. In fact, around one quarter of lump sums are used to pay off mortgages or make home improvements, while another 20 per cent are used to clear debts or buy a car.2

Lump sums can also be advantageous in the implementation of specific financial advice strategies, such as to manage cash flow from retirement accounts subject to the $1.6 million transfer balance cap.

And they can be useful where retirees are trying to reduce the impact of tax to be paid on death.

Growing future cashflows

But there are also some downsides to lump sum super withdrawals.

The biggest downside to taking a lump sum in cash is that it can then be harder to grow retirement savings into a much larger stream of cashflows in the future.

Even modest retirement savings, when invested appropriately and drawn down as an income stream, can make a big difference to the potential to live life comfortably and enjoy retirement.

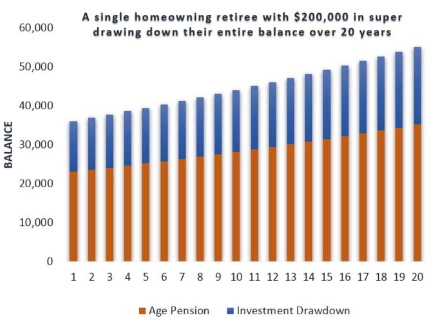

For example, a single homeowning retiree with $200,000 in retirement savings may be surprised how that money, if sensibly invested, could significantly change their retirement lifestyle.

If invested to achieve an average annual return 3 per cent above the rate of inflation, they would receive $13,000 (a figure which would increase with inflation) per year for 20 years.

With the government Age Pension for a single homeowner currently worth $23,000 per year, that sum plus the cash flow from their investment increases their annual spending power to $36,000 per year – a significant 55 per cent increase in their annual income. This is illustrated in the chart below.

Source: AMP Capital, 2018

A third way

Ultimately, managing money in retirement is all about confidence, and it’s an unfortunate reality that many retirees are too uncertain about what the future may hold to enjoy their savings.

Uncertainty around investment returns, health costs and how long their money will need to last all combine to make most Australians ‘over-save’ throughout their retirement – to the benefit of the next generation, but at the cost of living retirement to its fullest.

But by segmenting their retirement savings early in retirement, retirees can invest their money in different ways to match their different needs, goals and the risks they face rather than simply investing their money in its entirety and drawing down an income.

A financial adviser can help you prioritise your goals, work out how much money to allocate to each goal and then choose an investment strategy that maximises the chances of reaching each goal.

Types of retirement goals

Retirement goals can be diverse, but most belong to one of three main categories: essential needs, lifestyle wants and legacy aspirations.

Essential needs – include things such as food, housing, transport and bills. To meet these goals a steady cash flow, which keeps up with the cost of living is important.

Lifestyle wants – include things such as enjoying hobbies, holidays or new, big ticket items such as a car or caravan. To help fund these goals, investments should grow steadily over time and have a low probability of producing major losses.

Legacy aspirations – include leaving something for future generations which retirees with additional financial resources may aspire to do. Money allocated to these goals should be invested to deliver strong, long-term compound growth.

Taking a goals-based approach could give you the confidence to enjoy your retirement to the full.

1, 2 Australian Centre for Financial Studies, Funding Australia’s Future Financial Issues in Retirement: The Search for Post-Retirement Products, October 2015.

Author: Darren Beesley, BCom FIAA, Head of Retirement and Senior Portfolio Manager, Sydney, Australia

Source: AMP Capital 17 Jan 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.