Epidemics can rattle markets, and as fund managers we need to know what is worth reacting to and what is a product of the 24-hour news cycle. Here, we share some learnings for advisers and investors facing information overload.

In the age of information, it can be easy for investors and advisers alike to be swayed or distracted by articles, statements and opinions which lack evidence, rigour and analysis. Certain headlines can be frightening and foster an air of anxiety.

Our role as guardians of clients’ capital means we apply refined filters to assess incoming information and guide our investment decisions. We have models to help us separate signal from noise during the regular flow of economic data, however navigating ad hoc events for which there may not be a ready-made model, is another critical aspect of portfolio management.

The situation unfolding with the Coronavirus is, above all, a human tragedy. For investment managers, who have a responsibility to be a steady hand during this time, it represents an ad hoc event to interpret and manage with caution. We share some of our thinking on the Coronavirus below, with insight to our thinking and processes during events of this nature.

1. Monitoring scale and severity

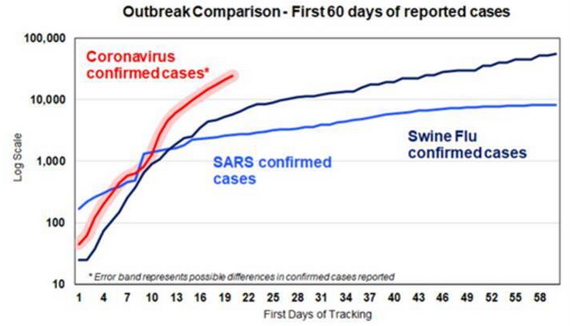

The scale of an epidemic is an important factor in analysing market impact, but you first need to determine what to measure. In the case of an epidemic, mortality rates hit our fear impulse hardest. However for financial markets the significance of an event like this boils down to the level of disruption caused to regular flow of goods and people.

By way of example, over 11,000 people died from the Ebola outbreak in West Africa in 2014.However the disruption caused to the global economy was much less than we’ve seen with the Coronavirus that originated in Wuhan, because of the differences in population density and the impact to global supply chains.

The media has placed a high value on the mortality rate, and the undeniable human tragedy this situation entails. As investment managers, our lens includes various other factors. Our focus has also been on the level of disruption caused to the economy, a function of the scale of the response required to contain the epidemic (e.g. flight cancellations) and the likely time to containment. In that respect, coronavirus has already exceeded both Ebola and the SARS outbreak in 2003.

Sources: PRC National Health Comm, Johns Hopkins CSSE, WHO, AMP Capital

2. Understanding context and the knock-on effect

The economic context also sets the scene for how harshly an event can impact markets. Further, it has large bearing on how lengthy the recovery phase will be.

In the case of SARS, GDP in China fell by over 2% in the June quarter of 20031. The economic backdrop wasn’t particularly helpful at the time – the global economy was still feeling the effects of early 2000s recession which saw the collapse of Enron, bursting of the Tech bubble and the September 11 terrorist attacks.

While the situation isn’t quite as dire this time around, the virus has arrived at a time where great hope has been placed on emerging markets’ ability to rebound from an 18-month long US-China trade war. China was set to play an important role in this rebound story and, critically, it’s share of global GDP has increased nearly three-fold since the 2003 SARS outbreak2.

Equity market watchers will also be acutely aware of the markets sensitivity to US-China trade relations, and the coronavirus raises new questions about China’s ability to meet its obligations under the recently signed Phase One trade deal when it agreed to buy large quantities of US goods in exchange for tariff relief. Compounding the issue is the looming US Presidential election where Trump may not be in the position or mood to offer the type of leniency China requires to avert a more dramatic slowdown.

3. Adding a grain of salt

There have been some fairly wild conspiracy theories circulating since the onset of the Coronavirus, which the World Health Organisation (WHO) has called out3 as damaging and unnecessarily fear provoking.

The WHO has also been compelled to address some specific myths in an online fact sheet – including that eating garlic or covering your body in sesame oil helps prevent the Coronavirus.

There are also a number of more sinister headlines and theories in circulation, including that the virus was a biological warfare experiment gone wrong and the passing of the doctor that discovered the virus was part of an elaborate cover up. Absurd as some of these stories may seem, they do have the ability to impact an investors mindset and undermine the level of trust in the official reporting.

Here, a little situational awareness and rational thought can provide a timely filter. This is critically important when making investment decisions and analysis.

Over the past 16 months, China’s hog population has decreased by approximately one-third as a result of African Swine Flu, resulting in an 110% increase in the price of pork4. Under these circumstances it is reasonable to assume some behavioural shifts by the Chinese consumer, i.e. an increase in demand for substitute meats which may have unintentionally created the conditions for a coronavirus. It is also reasonable to assume that the doctor that sadly passed away was working tirelessly to help contain the virus, which compromised his immune system.

A portfolio manager deals in probabilities and thinking along these lines can be a vital debunking tool which allow you move on quickly to other things.

“At the WHO we’re not just battling the virus, we’re also battling the trolls and conspiracy theories that undermine our response,” WHO Director General Dr Tedros Adhanom Ghebreyesus said. In that statement, he endorsed a headline from The Guardian5 reading “Misinformation on the Coronavirus might be the most contagious thing about it.”

By and large we are closely monitoring sources like the WHO, while taking note of studies from other credible institutions, such as the London School of Hygiene and Tropical Medicine and the Imperial College London as they become available.

4. Keeping calm

As our chief economist, Dr Shane Oliver, often reminds us: our worst-case fears are just that – worst-case fears, and experience in recent history confirms this. Our senior economist, Diana Mousina, has also pointed out how fears of a Spanish flu type of situation – which was in 1918 and killed about 50 million people – have not yet come to pass here.

So while there is no doubting the severity of the Coronavirus; the disruption it has already caused and could cause were it to morph into a pandemic, an investment manager must remain grounded by probabilities because a steady hand is imperative during times of crisis.

With the benefit of a tried and true investment process and an ability to identify the facts that matter, we can get on with doing what we do best: growing and guarding our client’s capital.

1 National Bureau of Statistics China, Bloomberg 2020

2 https://www.imf.org/external/datamapper/PPPSH@WEO/OEMDC/ADVEC/WEOWORLD

3 https://www.bbc.com/news/world-51429400

4 https://www.forbes.com/sites/siminamistreanu/2019/12/28/chinas-swine-fever-crisis-will-impact-global-trade-well-into-2020/#57a3ba1531ae

5 https://www.theguardian.com/commentisfree/2020/feb/08/misinformation-coronavirus-contagious-infections

Author: Brad Creighton, Portfolio Strategist – Dynamic Markets Sydney, Australia

Source: AMP Capital 18 Feb 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.