The ASX 200 is now back to about 10% below the record 7,200 level it hit in February last year, just before the virus rocked the world. We think many sectors are in great shape after coming lean and mean out of the crisis with strong earnings momentum. Further, Australia is about six months ahead of a global synchronised recovery, and there is the potential to push through and reach new index highs as momentum and faith in the recovery takes hold. Profits and their trajectory of their rebound are key to this confidence.

As we move into this February’s reporting season, the prospects for Australian listed companies seem considerably brighter than at any point since the beginning of the pandemic. Profit estimates are improving strongly, positioning the market for an August in which we could witness the fastest rate of growth in earnings per share in a decade – all against the backdrop of building economic momentum at home and with more to come from overseas.

Dividends bottomed in August 2020 and are now increasing again. We think investors will be looking to management to signpost this profit and dividend recovery, with formal guidance if they can. Where dividend guidance is provided, especially in the case where that company had previously suspended dividends, it will demonstrate a firm’s confidence in its footing, balance sheet and cashflows, and will help the stock re-rate.

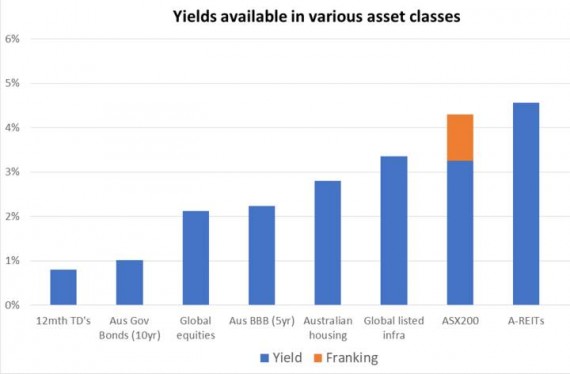

Profit estimates are also rebounding vigorously, heralding the start of a new market and dividend cycle. For all the recent focus on growth stocks, it bears mention that an asset class with the potential to deliver income in the order of 5% with some capital upside is a very rare and attractive thing in our low-rate global environment.

Beneath the surface, at a more granular stock and sector level, we believe performance in such a novel environment will vary considerably. For us, following the cashflow – including outsized dividends in retail and resources – as well as capitalising on beneficiaries of the recovery in the energy and healthcare sectors, is key. The danger lies in overreaching in those sectors for which values have already been stretched, such as tech, and in prematurely anticipating recovery for stocks still heavily impacted by COVID-19 in sectors such as tourism and travel.

Source: AMP Capital, FactSet, SQM Research. As at 31 January 2021.

Given the uneven and uncertain nature of the recovery so far, with fresh outbreaks and still-emerging clarity around Australia’s vaccination program, insights into the challenges faced by each particular business are highly valuable, and there may well be some surprises, both positive and negative. We think it’s good to try to keep perspective and look for opportunities, though some stocks might disappoint.

Here are a few our thoughts on key sectors for reporting season:

Domestic cyclical stocks

If the upswing in the Australian economy does continue through 2021, we think the usual suspects which benefit from increased domestic economic activity will perform well again.

Retail

In spite of the occasional lockdown, we believe that there are early signs that cashflows for Australian retailers remain healthy. There appears to be a YOLO effect (You Only Live Once) at play, where those who’ve come through a troubling year with unanticipated savings as a result of limited spending opportunities are happy to open their wallets as the crisis subsides.

Iron ore minersIron ore prices are at near-decade highs1, creating a cashflow bonanza for the miners. However, we are keeping an eye out for falling steel production in China.

Bulk electricity users

With electricity markets across the country suffering from weakness and disruption, we think manufacturers who rely on large amounts of cheap power to turn a profit – such as lithium processing plants – are likely to benefit as electricity costs fall.

Travel and tourism

This sector will join the recovery at some point, although given our past reliance on inbound international tourism and the reality that the logistical challenges of re-opening might take longer than previously thought, it is likely to be a bumpy road ahead – especially for business travel. In the meantime, many stocks in the sector remain overbought.

Housing

The RBA is committed to quantitative easing in the short term and low rates for as long as it takes. In combination with record levels of savings, these settings have produced a groundswell, if not a surge in both sales and development of residential property. This performance is at odds with what looks like very stretched valuations and, in many places, falling rents. That is to say nothing of unanswered questions around demand linked to a collapse in Australia’s immigration rate.

We are remaining cognisant of these mid-term risks, however we believe there is money to be made over the short term. In our view, this may not mean buying into the asset class, but instead investing in the provision of the trowels, hammers and building materials that will fuel the continuation of the boom.

Offshore reopening trades

Even countries such as Australia and New Zealand, which have escaped the worst of the pandemic, will have trouble navigating our way out, and these risks increase in abundance in most foreign markets. In addition, the rising Australian dollar looks set to take a slice out of any profits earned overseas.

Buy now, pay later (BNPL)

We think BNPL companies continue to trade at risky valuations, despite the dissipation of the surge of users that accompanied early lockdowns.

There will be bumps and breathers on the road, but stay long the recovery

Though there has been lots of noise, the Australian government has done an admirable job stabilising the economy and maintaining enough momentum to enable this strong recovery. An early and emphatic stimulus helped bridge the fall-off in demand through the early days of the pandemic, and supported businesses and individuals so that they were in a position to contribute to the upswing once lockdowns had eased. As a measure of the program’s success, many companies are already in a position to repay the assistance they received. We do expect some further targeted support for small-and-medium sized enterprises, but the government is looking to step back now that the economy is back on its feet. There will be a period of adjustment, and some businesses will struggle and even fail. Try not get distracted.

Now that valuations have rebounded and we’ve had a jump in earnings expectations, the market might take a wait-and-see approach as companies adjust to the withdrawal of stimulus, but we think it’s best to stay long on the recovery. The old adage rings true: buy to the sound of cannons and sell to the sound of trumpets. The time to get defensive may not arrive until the global vaccination phase is over, the rest of the world is sharing in our good fortune and the market is cheering the gains. We are on that road, but not there yet.

1. https://www.mining.com/iron-ore-price-turns-higher-again-after-record-china-imports/

Author: Dermot Ryan, Co-Portfolio Manager, Equity Income, Sydney, Australia

Source: AMP Capital 15 Feb 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important note

While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.