“How well aligned are ESG managers and ESG investors?”

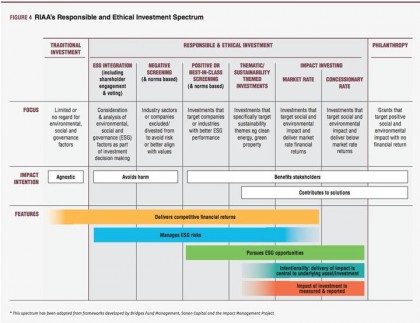

The ongoing growth in environmental, social and governance (ESG) investing has been driven by investors who may share certain common characteristics, but who have different concerns and commitment levels towards ethical investing.

This growth has unsurprisingly been accompanied by a proliferation of ESG product offerings from an increasing number of fund managers. However, they may take significantly different approaches in balancing the need for market performance alongside delivering positive and sustainable social and environmental outcomes.

Investors should recognise that not all ESG managers are created equal. Investors who genuinely wish their savings to be invested within a values-driven framework should identify a manager whose values align with their own, rather than one who merely acknowledges ESG risk management as a hygiene factor.

Sensitivity to performance

ESG investor behaviour is characterised by a sliding scale of commitment amongst investors and consequently the level of priority that they accord it differs.

At one end of the scale are investors who are sometimes described as philanthropic investors and are highly committed to allocating funds within a clearly defined ethical framework. They prioritise making a positive impact ahead of making portfolio returns, especially in the shorter-term.

Further along the scale, many institutions remain focussed on delivering long-term performance to their underlying investors but genuinely take ESG oversight seriously. They may well engage with the fund manager every quarter and pay close attention to the ESG credentials of all stocks within the portfolio.

At the other end of the ESG commitment scale are investors for whom ESG is perceived as a hygiene factor while their primary focus is firmly on maximising returns. The expectation is that controls are in place to manage the most significant ESG risks and ensure that the governance requirements of the mandate are being met.

Source: Responsible Investment Association Australasia – https://responsibleinvestment.org/wp-content/uploads/2018/08/RIAA_RI_Renchmark_Report_AUS_2018v8.pdf

It is perhaps unsurprising that investment managers adopt differing approaches to managing ESG risks in their portfolios. Some see this as a hygiene factor reflected in a page on their website that sets out a policy reflecting a broad approach to regulatory compliance and managing the risk of ESG impacts. However, others view it as an opportunity to build their entire investment process around an ethical framework. Instead of a mere marketing tool, they see a way to achieve environmental or social outcomes while delivering long-term value to investors.

This variety of approaches was reflected in the recent Global Impact Investor Network survey that showed 66% of impact investment managers principally target risk-adjusted market rate returns. This implies that they are unwilling to accept a below-market return while pursuing ESG focussed investments. However, investment opportunities are available that deliver positive environmental and social outcomes alongside return expectations; hence impact investors can be values driven whilst also seeking positive investment outcomes.

Making a positive impact

The traditional approach to ESG investing has been based upon excluding from the investable universe those companies that fail a screening process. In practice such companies are those whose activities are likely to cause harm to society or the environment, calling into question the long-term sustainability of their business model and earnings stream.

Such businesses might rely on the sale of tobacco or weaponry, pollute the environment, make an unacceptable contribution to climate change or carelessly manage their supply chain at the cost of vulnerable workers.

Such an approach represents progress upon traditional standard investing techniques, but investor thinking in this area has since progressed further. Some investors now increasingly expect their investments to make a positive impact on the wider world.

Impact investing might include equity investment in a developer of green energy technology, private equity investment in educational services, green bonds that finance wind farms or real estate investments that are both low energy and serve a social purpose such as aged care or social housing.

Real estate managers can go further and make a positive impact by investing in solar power. Shopping centres that use most of their energy during the day – when it is typically sunny – represent a solar power opportunity. However industrial premises, such as warehouses, tend to have more modest energy requirements and currently have limited solar generation potential. This is because exporting excess solar power into the grid is not remunerated at the same rate as drawing it down from the grid. Hence solar systems are generally sized to meet the energy demand of the building, rather than the maximum generation potential.

Managing ethical issues

A particular challenge of ESG investing is the divergence in thinking across institutions when considering the societal and environmental impacts of their investment activities. It is uncommon for two different investment policies to contain identical exclusions or even philosophies towards investing.

In particular, ESG investors may focus on a narrow or broad range of issues. Viewing the investment universe through a narrow lens is less common, however investors with a broader range of concerns are likely to hold different levels of concern and different priorities.

Carbon emission minimization for example, is typically a key feature of ESG investing, however policies vary significantly from those institutions that screen out only the most egregious emitters of CO2 to those that demand zero carbon emissions from all companies in which they invest.

Issues that tend to enjoy a high level of investor consensus include tobacco and prohibited weapons, such as chemical, biological, cluster munitions and land mines. There is widespread agreement amongst ESG investors that such products do unacceptable harm and that they should not invest in businesses whose primary purpose centres on their production.

However, there is greater ambiguity when businesses engage in excluded activities, but only as an incidental part of their overall business operations. An example might be a diversified mining company that provides essential raw products that are widely used, such as iron ore, aluminium and copper, but also engages in coal mining. It is now widely accepted that coal mining and its subsequent burning in power generation contributes to harmful climate change. Whereas a committed ethical investor would screen out such companies, an ESG risk focussed investor might consider them further if they had overall strong ESG characteristics. These might include mining efficiently and remediating mine sites upon the completion of operations.

Other areas where investors are likely to adopt differing positions are in the fields of animal rights or human rights. Investor attitudes towards such issues depend on values, which are likely to vary materially from one investor to another. Whereas ESG investing is based on scientific evidence correlating environmental or social harm with a business activity, an ethical approach rests upon a values framework which might be driven by a desire to avoid all harm to animals.

Managing supply chains in a responsible way has been a key ESG priority since the 2013 Rana Plaza disaster when 1,134 garment workers were killed in a building collapse in Bangladesh. The expectation that companies source supplies ethically is widely held. Most well governed companies understand the risks to their business in the form of operational disruption and reputational damage, which may occur if something goes wrong in the supply chain. However, investors do expect fund managers to engage with companies and to endeavor to hold them accountable for their supply chain practices.

Governance is another area of ESG investing where investor expectations and manager priorities vary. Diversity, executive pay, shareholder rights and board independence are all key areas which require engagement by investment managers. However, the relative importance that investors attach to different aspects of the governance process will depend on perceptions of long-term value that can be created through such a focus.

1 The Global Impact Investment Network (GIIN): Global Impact Investor Survey 2017, (2018), p3 https://thegiin.org/research/publication/annualsurvey2017

Source: AMP Capital 25 October 2018

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.