Over half of the Aussie population sit in lockdown as the Delta strain of the COVID-19 batters most of Australia. We are experiencing some very difficult challenges in controlling this latest Delta strain, which is far more transmissible and even poses as an infection risk to those who are lucky enough to be vaccinated. With less blanket government support packages on offer and the world in disarray, what should investors be expecting from Australian shares in the coming months? Will lockdown lock up FY22 dividends and capital returns? We think not and have set a 5.7% distribution target for our Equity Income Generator Fund which will be paid out in level monthly installments this financial year1.

With earnings season just around the corner we don’t have to wait too long to hear from the management teams of the country’s largest firms. It’s important to remember dividends are both backward and forward-looking at this part of the cycle. As we can see from earnings pre-releases on the ASX, the first six months of trading in 2021 in Australia have been very strong2 as we have been overstimulated and had experienced virtually little impact from the COVID-19 pandemic, except for industries like travel, education and airlines – which have been hurt by international border closures. Conditions have obviously deteriorated quickly, as some forms of economic activity have been brought to a halt in lockdown. Boards have to look at both their company’s balance sheets and outlook when setting dividends, especially when they are resuming payouts after cutting them back in the crisis.

The banks raised capital last year to shore up their defences against loan losses due to the coronavirus pandemic3. But in hindsight, we think it was broadly not needed as the economy accelerated into a V-shaped recovery. We believe this means the banks should have plenty of cash on hand to give back through higher dividends, special dividends or share buybacks. Thanks to the robustness of the housing market, and with the risks of the pandemic receding into the rear-view, we expect banks will start releasing provisions – funds held over in case of a COVID-related housing crash during 2021 – back to shareholders over the next 12 months. While this might take longer if arrears appear from this current lockdown, we have already seen a large major bank approve an on-market buyback of $1.5 billion4. The other big-four banks have higher capital levels and franking credits on their balance sheets5 and so may be able to come with off-market buybacks, which are much more valuable to retirees and super members due to the franking credits attached.

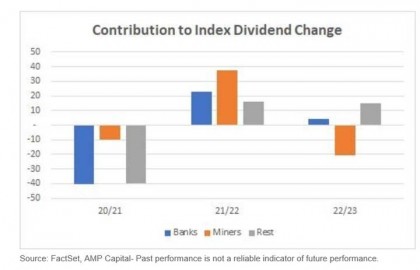

At the same time, record iron prices are pumping up profitability in the resources sector, leading to our opinion that the big four banks and the top three miners, the behemoths of Australian income stocks, are all poised to deliver massive dividends. The big iron ore companies are sitting on plenty of cash thanks to the record high iron ore prices over the past six months6. To put that into context, iron ore prices are currently trading well above $200 a tonne. Twelve months ago, they were less than half that level, and back in February last year, they were almost two thirds lower. Iron ore prices have been at the current level for around two months, and the big winners have been the local miners . The big iron ore miners are now “ex-growth”. Their end steel markets are mature and we believe it’s the right thing to give money back to shareholders.

It is not just about the banks and iron ore miners7. While they are expected to be splashing cash around in the near term, in our opinion their capital growth profiles don’t look quite as good as some other sectors. On a total return basis, particularly over the medium term, we think that other parts of the market look relatively attractive. Dividends on about half of the top 200 ASX stocks still have not caught up to pre-pandemic levels, on a cents-per-share basis. This suggests that there may be plenty of companies that will start to make inroads into that gap this earnings season.

The mid-cap, industrial, domestic sector stocks are promising and so too the retail sector in our opinion. Many of the mid-cap companies – outside the top 20 – seem to have good operating leverage. We think the current environment suggests very strong revenue whilst emerging inflationary pressures are not yet strong enough to materially impact cash flows.

Source: FactSet, AMP Capital- Past performance is not a reliable indicator of future performance.

There will probably be buybacks from retailers, this earnings season. In fact, we have already seen buyback announcements from some major retailers8,9. Profits are expected be strong as well. Once vaccinated, people will return to work in the office and will want to buy new clothes, whilst kids going back to sport need new equipment. Many of us have gone up a size or two thanks to COVID-19, so a wardrobe refresh might be in order! In the meantime, it’s online sales, but retailers now have low levels of net debt. In a rebound, retail companies are in a position to give the money back to shareholders or invest in expansion and generate a better return on capital in the medium term.

Of course, as the most recent wave of coronavirus is demonstrating, there are always risks to earnings from a big coronavirus outbreak. Each time the virus mutates, it becomes more difficult to contain. COVID-19 will be an ongoing health challenge and rolling out vaccines is the antidote. From a financial perspective, risks of further lockdowns should decrease as we get more of the population vaccinated. But while the economy was overheating with stimulus before the current lockdown, we believe this will help ensure the economy continues to have escape velocity to get us to the reopening phase. It also ensures the RBA stays in an overly accommodative stance, which may be a problem for residential housing in the medium term. Nonetheless, prior stimulus should be supportive to stocks and the broadening corporate acquisition spree happening across the index.

COVID-19 won’t just end. We believe it will remain an ongoing theme of the outlook. It will have a cost and impact, and so in our opinion, healthcare stocks are worth considering – for instance, pathology, hospitals, aged care. Given the vaccine rollout is expected to accelerate from here, we think it is important not to be scared out of holding positions in companies that have the strength to get through this challenging period.

Investors in Australian equities could gain near-term rewards from our outsized banking and resource sectors. We believe both will come despite the challenges facing the current Delta-strain lockdowns. Nonetheless, the pullback in July sees the ASX 200 Index back to around its pre-COVID levels of 7,20010. In our opinion, the key to good portfolio returns from here will be the pace of the continued profit recovery and picking those stocks outside of our largest two sectors (banks and resources) that can expand into the broader economic recovery.

If you would like to learn more please register here for Dermot Ryan’s upcoming webinar – A look at Australian equities earnings as we emerge from the pandemic.

1. Please see estimated distribution assumptions note at the end of this document.

2. AMP Capital, FactSet.

3. https://www.afr.com/companies/financial-services/backing team australia will cost banks billions 20200428 – p54nwf

4. https://www.afr.com/companies/financial-services/anz announces 1-5 billion buyback 20210719 p58b4s

5. FactSet, AMP Capital.

6. https://www.reuters.com/world/asia-pacific/iron ore seen driving australias resources export earnings record 202021 – 2021 06 27/

7. Bloomberg. As of 13 July 2021.

8. https://www.afr.com/companies/retail/metcash launches 175m buy back as profits soar 20210627 p584pb

9. https://www.afr.com/companies/retail/woolworths returns up to 2b if drinks split approved 20210510 p57qdf

10. FactSet. As at 21 February 2020.

Author: Dermot Ryan, Co-Portfolio Manager (Income), Sydney, Australia

Source: AMP Capital 30 July 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMPCFM) is the responsible entity of the AMP Capital Australian Equity Income Fund, known as the AMP Capital Equity Income Generator (Equity Income Generator) and the issuer of the units in the Equity Income Generator. To invest in the Fund, investors will need to obtain the current Product Disclosure Statement (PDS) from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232 497) (AMP Capital). The PDS contains important information about investing in the Fund and it is important that investors read the PDS before making a decision about whether to acquire, or continue to hold or dispose of units in the Fund. Neither AMP Capital, AMPCFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to their objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

Distributions for AMP Capital Equity Income Generator are preannounced six months in advance. Distributions for the AMP Capital Income Generator may be preannounced six or twelve months in advance. It is important to note that the final annualised distribution yield will not be known until the end of the financial year, that the distribution yield estimate is not guaranteed, and that it may change due to market conditions.

Estimated Distributions Assumptions: The estimate is based on the amount of income we expect to receive into the fund over the period from 31 December 2015 to 30 June 2016, based on the current investments held by the Fund, the level of dividends and franking credits expected to be earned from investments held in the Fund. If the companies whose securities we hold in the fund do not pay the dividends or franking credits they have forecast, or if the Fund portfolio changes materially over the period, this may impact our estimated distribution amount.